Up to 9% of salary: what will the new pension reform change in Ukraine.

11.12.2024

2193

Journalist

Shostal Oleksandr

11.12.2024

2193

The new pension reform involves the introduction of accumulated contributions without increasing the fiscal burden on employers and employees

According to the concept of the new pension reform, contributions will be introduced gradually. In the first year of the reform, the total contribution will range from 2% to 3% of the salary. This contribution will consist of three sources: a 1% reduction in the single social contribution (SSC) and personal income tax (PIT), as well as a 1% voluntary contribution from the employee. The voluntary contribution will be collected automatically, but the employee can refuse it.

In the second year, contributions will increase to 2% from each source (up to 6% in total), and in the third year - to 3% (a maximum of 9%). Starting from the fourth year, only the 3% contribution will remain mandatory from SSC. The state will match the employee's voluntary contribution, but no more than 3% of the salary.

According to the Ministry of Finance, every percentage of state compensation could cost the budget 22 billion UAH.

Read also

- The number of blocked tax invoices has decreased by half - State Tax Service

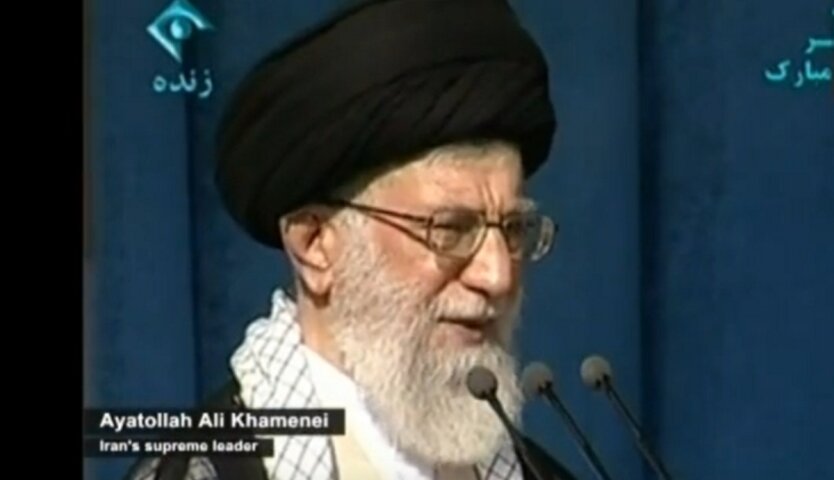

- Reuters: Gulf countries prepare for chaos in the event of the Iranian regime's collapse

- Britain highlights threats to Putin due to escalation between Israel and Iran

- Another group of seriously ill Ukrainian defenders has been released from Russian captivity

- Ukrainian wheat prices are falling ahead of the harvest season

- EU seeks ways to save Ukraine amid Trump threats: a discussion about Russian money